Lexon’s overall position remains robust despite the impact of COVID-19 on investment results and the ‘one-off’ 20% reduction in base levies announced in April.

The careful and prudent management of insurance reserves and the profession’s strong commitment to risk management enabled Lexon (in partnership with Queensland Law Society’s Council) to again deliver on our goal of supporting our insured law practices.

A bespoke insurance partner

It is opportune to compare our partnership with you with the experience of the profession in the United Kingdom. In June 2020, the Solicitors Regulation Authority (SRA) provided an update on the state of their market. It provides some useful insights into the challenges a commercial insurance model faces compared to the bespoke solution adopted in Queensland.

The SRA’s update noted that:

- Their market has “hardened and contracted significantly”.

- This was driven by issues including as an increase in claims and features of lawyers’ insurance unattractive to commercial insurers.

- Some insurers have been pulling out of the market completely, including two in the last year, leaving 180 firms looking for a new insurer.

- Insurers that remained in the market reported a trend of having less capacity and a reduced risk appetite. This means that they are playing safer about who they choose to insure and on what terms.

- Premiums to April 2020 have been reported to be increasing, on average, by around 15-20%.

- Some firms are struggling to find insurance at all. This may include higher risk firms and firms whose previous insurer has left the market.

- The above all preceded COVID-19 and its effects are further impacting the market.

Compared to this experience, it is relevant to note that the Society’s insurance scheme has:

- Maintained low claim values (no doubt driven by the long-term investment in risk management).

- In Lexon, a stable and well-run insurer which is always available to meet claims.

- The capacity to reduce levies for the profession when it is most in need, rather than seek to charge a commercial ‘mark-up’.

Claims profile

As at 30 June 2020, we recorded 348 new matters in the 2019/20 year compared to the 327 received in the equivalent period for the 2018/19 year. The upward movement in file numbers did not translate into higher claim values, which diminished year on year by over $2.4M (to $10.6M).

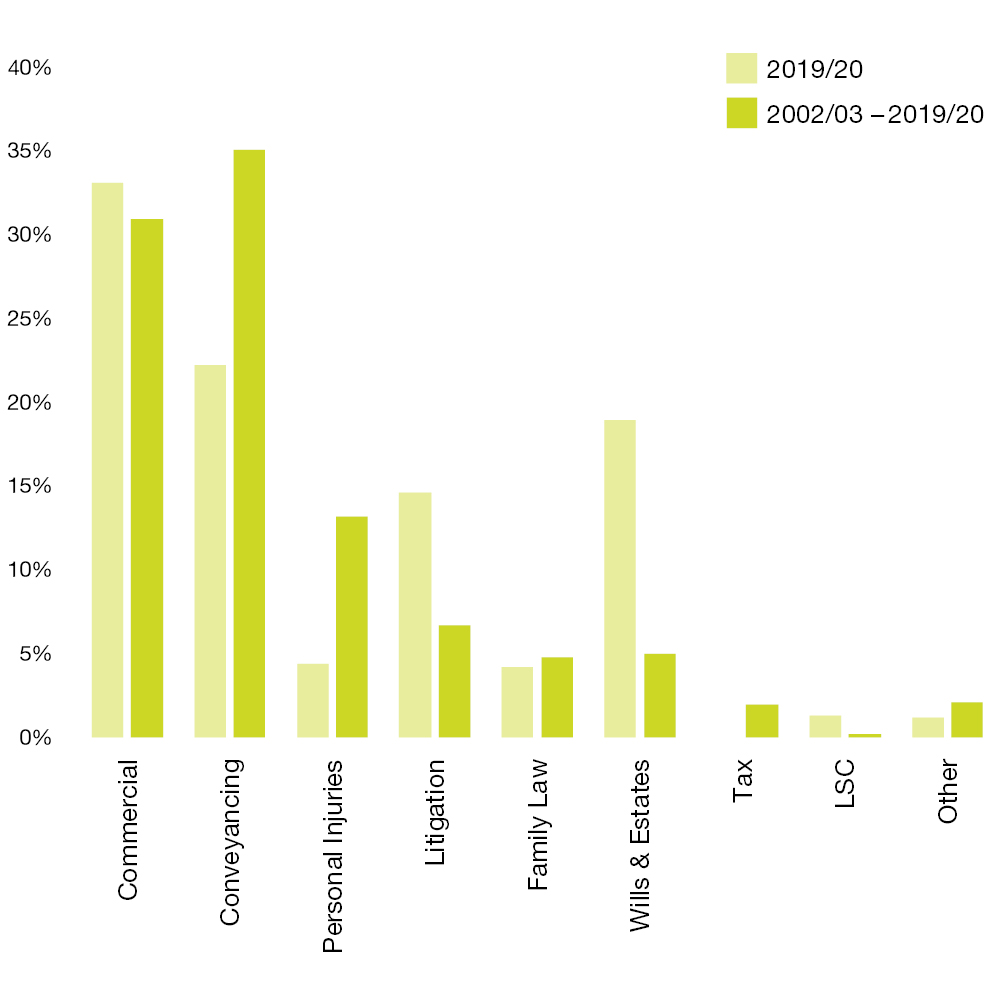

Conveyancing continues to be the most frequent type of matter (26.4% of all files) and contributed 22.2% to overall portfolio cost. Commercial matters contributed the largest proportion of the claim value (representing 33.1% of the portfolio cost) whilst only contributing 17.0% of the file numbers. This reflects the larger average value of commercial claims.

The graphic below compares the portfolio breakdown by area of law for 2019/20 with ‘all years’. Overall claims values remain in line with the long-term average despite a growing profession. Claims containment remains our primary goal.

Claims cost by area of law

Some important policy changes for 2020/21

With the introduction of a specific Cyber Deterrent Excess in 2020/21, the policy has been updated to make provision for this new concept. Implementing some simple steps can reduce the risk of a claim and also mean avoiding a deterrent excess.

LSC Extension cover is now predicated upon the insured incurring and paying $3000 – the equivalent of what was the six hours’ free legal advice benefit previously available under the FLAP entitlement plus the prior $500 excess.

The changes are further explained in the document entitled ‘Outline of Changes to Master Policy No.QLS 2020 and the 2020-2021 Certificate of Insurance’ which can be found on our website.

I am always interested in receiving your thoughts, so if you have any issues or concerns, please feel free to drop me a line at michael.young@lexoninsurance.com.au.

Michael Young, CEO

September hot topics

Cyber fraud risks – protect yourself and avoid a deterrent excess

Whilst Lexon’s policy may respond to third-party losses resulting from cyber frauds, prevention is certainly better than a cure, particularly given the introduction in 2020/21 of a specific deterrent excess for cyber-related losses covered by the Cyber Protocol.

Some of the practical steps you can take are outlined below:

Use Lexon’s risk management letters, tools, checklists and other cyber resources

Use the relevant suite of tools developed by Lexon to reduce the risk of the loss of funds through cyber-attacks. Cyber is not just a conveyancing issue, attacks have occurred across other areas of practice as well. All of our risk packs have updated cyber warnings and prompts included.

Additionally, meet with your IT advisor to work through these cyber publications (all available on our Cyber page):

- ‘Enhance your cyber security while working remotely’

- ‘Assessing risks with electronic service providers’

- ‘Where to deploy Multi Factor Authentication’

- ‘Cyber Security LastCheck – IT Systems’.

Email footers

Note our risk alert advice to not put electronic instruction warnings only in your email footer – fraudsters have intercepted these communications and have deleted the footer before sending the fake email – make the warning a part of your standard first retainer letter. You should also use our recently updated Cyber Alert (found in our Client Intake Pack) as the first page of your first communication to a client in a new matter.

Conduct ‘Read Out Read Back’ before any funds are transferred

Prior to funds being transferred make sure you verify the authenticity of any electronic communication containing account details by reading out and reading back these details via a telephone number verified from a source other than the communication.

If a fraudster is monitoring your emails this step will make their job that much harder. Failure to follow these steps can result in a deterrent excess being applied. Familiarise yourself with the Cyber Protocol (available on the Lexon website) which covers this and other warnings you should provide.

Have all your staff complete our complimentary online cyber security training course

Last year Lexon released a bespoke online Cyber Training course. Additional modules were added in June this year. This course has been designed to assist practices to identify situations where cyber and related fraud risks exist which might expose your practice or client to financial losses. Your practice was sent log-on details and we strongly encourage you to complete the modules that have been released. If you have any queries regarding accessing the course, please contact Anthony Walduck at Anthony.walduck@lexoninsurance.com.au.

Maintain good cyber security and be vigilant!

Ensure that:

- Your virus protection, firewall and operating systems are patched and up to date.

- You NEVER click on a link included within an email without first hovering to check the link address. Many of the recent cyber-attacks have originated from clicking on a link in an email, where there appeared to be no immediate effect. When in doubt, call the apparent sender of the email to query the legitimacy of the email.

- You NEVER reveal user credentials and passwords (fraudsters may try and get these by masquerading as potential clients or using other targeted communications – this is covered in our complimentary cyber security training course).

- You adopt a less trusting mindset to email communications – healthy scepticism is required.

- If you think you may have been compromised, you immediately:

- change your passwords (for example, personal, server, domain hosting, PEXA)

- have your IT support provider review the matter including:

- IP addresses accessing your server

- monitoring for any new Outlook ‘rules’

- analysis of any links clicked on

- contact our Risk team who can discuss other time critical steps to take to minimise exposure.

- You avoid password reuse across different services – make sure that the password that you are using for your work email service is not used for other services like Dropbox, Hotmail, Facebook or other.

- You make sure email auditing is enabled. You can check this with your IT support provider.

- If you aren’t using it, you disable it. For example, if you only access Outlook on your workstation, consider whether your IT support provider should disable Outlook Web Access.

Did you know?

- 94% of practices insured in Queensland have one or two principals. Managing risk and providing claims support for such a large number of small practices led to Lexon developing its unique risk workshop model. At the same time, the remaining 6% of practices employ nearly 30% of all practitioners and this means Lexon also delivers bespoke claims and risk management solutions to meet their particular requirements.

Ensuring that we adequately cater to the needs of all practices, irrespective of size or location is an exciting challenge which drives our continual innovation.

- In 2018 Lexon added Cyber Workshops to our extensive list of free in-house risk visits. Our Cyber Risk Consultant, Cameron McCollum, takes practices through some simple measures that could have prevented claims we have seen, and some system level controls that you can discuss with your IT adviser. If you’d like to get a head start you can download our Cyber Security LastCheck and arrange a meeting with your IT adviser now to work through it.

If you haven’t already scheduled your practice for a visit, email Cameron.mccollum@lexoninsurance.com.au to register your interest. Cameron will be progressively visiting all areas where insured practices have offices.

- For the 2020/21 insurance year, QLS Council arranged with Lexon to again make top-up insurance available to QLS members who sought the additional comfort of professional indemnity cover beyond the existing $2 million per claim provided to all insured practitioners. An application form can be found on our website.

Share this article